Idea in Brief:

Poverty is often viewed through an individualistic lens, with efforts to respond focusing exclusively on households rather than the broad place-based social and economic ecosystems in which those households are embedded.

The city of Chester, PA illustrates the structural barriers many places experience in their efforts to overcome decades of economic harm and neglect, and to build lasting communal wealth

Policy efforts to build wealth should focus on existing assets, and should create new opportunities for investment that goes beyond the standard development playbook in order to facilitate growth without leading to displacement.

Introduction

HBO’s recent hit show Mare of Easttown stars Kate Winslet as a grief-laden detective charged with solving the murder of a local girl in a fictionalized version of Delaware County (Delco), included within the broader Philadelphia metropolitan area. Mare of Easttown expertly captures the texture of life in this part of my home state, where residents cheer for the Eagles while eating Wawa hoagies—and where they grapple with poverty, substance abuse, and deaths of despair.

Mare of Easttown is a powerful show, but it has a glaring flaw: it ignores the systemic dimensions of place-based poverty. For example, in a significant plot point, a teen mom turns to sex work to pay for ear surgery for her infant son. The show never asks us to think about the broader sociopolitical context in which a decision like that would take place.

As a nation, we are bad at thinking about poverty as a place-based reality. Our defining stories about wealth and upward mobility emphasize the individual absent any kind of ecosystem, physical or social. But when we step back to ask about the context of poverty, we start to see a more complex story that involves failing infrastructure, lack of public spending, restrictive zoning codes, and other such factors. Together, these factors inhibit efforts to attract new businesses while cutting off communities from important capital flows in adjacent prosperous areas.

This essay is about poverty considered as an explicitly place-based problem and about the place-based policy making we need in response. I’ll provide a theoretical framework for understanding the issues with our current “fiscalization of social policy.” Next, I will examine the city of Chester (in Delco) as a concrete example of an ecosystem of concentrated poverty. Finally, I’ll explore some promising recent policy interventions that can help us imagine a better approach to overcoming place-based poverty and creating communal wealth.

You Get a Tax Credit, and You Get a Tax Credit, and Everybody Gets a Tax Credit!

To understand why our current approach to social welfare is so limited, we need to start with a discussion of neoliberalism considered as an ideology. Much has already been written about this ideology, but I want to highlight two features: privileging the market over government and the myopic construct that is the “nuclear family.”

Neoliberalism argues that the government should take a backseat to the market, only interfering in the case of so-called market failures, including dealing with negative externalities (such as pollution.) Indeed, neoliberal politicians often take this one step further, glibly promoting the market as a superior provider of basic public goods, (An example is the school choice movement’s denigration of public school education, which will be relevant later). This ideology castigates all government action as essentially and inescapably ineffective or least inefficient. It also commodifies basic public goods by suggesting that they can be represented in the language and mechanisms of economic exchange. Over time, this ideology undermines all notions of a “public good” or “common good” that exists outside the market and indeed to which market forces should be subordinated.

Neoliberalism’s second relevant feature is its myopic focus on the “nuclear family,” understood as a discrete household unit consisting of one or two parents and their children (thus excluding grandparents, grandchildren, or other dependents). The nuclear family is presented as a focal point for addressing the “market failure” of poverty. Additionally, this feature of the neoliberal worldview looks at families through the lens of the tax code, with households as abstracted entities characterized by numeric value (e.g., the number of adults, single, married, or divorced and the number of dependents) and numeric relation to the market (who is working, how much they are earning).

This second feature is directly connected to the first. As Capita Senior Fellow Ian Marcus Corbin argues in his essay How Money Culture Hurts The American Family, the fairly new norm of emphasizing the “nuclear family” over households with extended family members is directly connected to the bureaucratic and managerial logic of modernity, which depersonalizes workers, viewing them merely as “human resources” or a pool of “human capital.” Corbin writes, “Wage levels, health care, time off to welcome a baby or raise children, the ability to put down roots in one location, to stay near family, these and much more look squishy and immaterial when compared to the great abstraction of the dollar.” And he warns that “the consequences of this value hierarchy are expansive—our choice of occupation, home, spouse, number of children, mode of child-rearing and much more fall under its shadow.”

Taken together, these features lead to our standard social welfare policy initiatives, which rely on the tax code as a mechanism both for determining who is eligible for assistance in acquiring basic public goods (like housing, healthcare) and for redistributing money and resources to those individuals and families, atomized and abstracted from any consideration of place. Scholar Joshua T. McCabe calls this “the fiscalization of social policy” in his book of the same name. He argues that neoliberal policy makers rely on tax credits as the primary tool for addressing poverty (particularly child poverty) to disguise welfare policy (“It’s not a handout to the undeserving poor, it’s a tax credit that will stimulate the economy!”). In his words, in this paradigm, “the [perceived] legitimacy of a policy depends not only on who is receiving it and whether it is effective but also on how they are receiving it.”

By channeling social welfare through the tax code, policy makers can also ensure (through elaborate means testing) that public benefits, including the Child Tax Credit, are tied to the market, in the sense that they are only available to those (documented) residents who participate in the economy directly as workers (or who are connected to those workers as spouses or children) and who report that activity to the IRS (thereby functionally excluding the poorest households, who do not earn enough to file taxes.) This is true also of Social Security, which functions not as a blanket guarantee of secure retirement for the nation’s elderly—as something we owe the eldery based on our understanding of the common good— but rather as a signal of how valuable a worker the eldery person was within the economic system prior to retirement. Here again, not only are public benefits reserved for those who participate in the market, but the whole conceptual apparatus is also tied to the language and processes of the market.

Aside from certain residency requirements, this fiscalization of social policy is place blind in two ways. First, it doesn’t matter to the IRS where the tax revenue is sourced: all that money could come from just Silicon Valley and as long as there was enough to meet budget requirements and spending priorities, the IRS would have no reason to care. This view was notably expressed by Hillary Clinton in her 2018 comment that “I won the places that represent two-thirds of America's gross domestic product....So I won the places that are optimistic, diverse, dynamic, moving forward” (the implication being that those are the only places that really matter.) Of course, one can easily critique the Right on this too; as Oren Cass argues in The Once and Future Worker, for decades the Right has been happy to strip away labor protections and push trade policies that leave places and people impoverished so long as GDP continues to grow.

Second, the IRS does not care about place in the redistribution of this money: it makes no difference if poverty is dispersed or concentrated, and indeed nothing about this approach would change if every single person who needed social welfare lived in the same five-mile radius. In that hypothetical, someone inquiring about the common good or about civic obligations might wonder if there are systemic failures here to address. But from the place-blind perspective of the IRS, the situation would simply be just another “market failure” for x number of individuals, requiring adjudication during tax season.

To be clear, I am not arguing that we should eliminate the social safety net. Nor is this an attack on the so-called welfare state—another neoliberal construct. Instead, I am arguing first that neoliberalism undermines our understanding of the common good and second that it treats only the symptoms of poverty. By disregarding place while simply redistributing wealth to individual households, neoliberalism ignores many of the root causes of poverty tied to physical and social ecosystems.

To see an ecosystem in action, let’s turn to the city of Chester.

Chester: A Case Study In Place-Based Poverty

To begin, I want to show you a map of three locations within the Philadelphia metro area.

The first location I’ve highlighted is Rittenhouse Square (right near the art museum), which is one of the most affluent areas in the center of the city. Second, I’ve highlighted the unincorporated census-designated place of Ardmore in Montgomery County (where I currently rent a studio) on the Main Line (where there is lots of both old and new wealth). Finally, there is the city of Chester, in Delco, with a 31.4 percent poverty rate (three times the national rate according to the most recent census data.)

Chester is the oldest city in Pennsylvania and is currently Black majority (68.9 percent). Chester was once an industrial hub for manufacturing, but it has experienced the same white flight and hollowing out of the urban core that marks many other cities throughout the nation, including Buffalo, Cleveland, and Detroit. As is typical of deindustrialization, the broader Philly metro area includes sharp place-based divides in where capital is concentrated, as well as persistent racial disparities in wages in the labor market.

(Above: A corner in the downtown area of Chester featuring a now-defunct restaurant, a check- cashing center, and a Black-owned barbershop. Below: farther away from downtown, residential housing and apartment complexes.)

Many important features of Chester’s ecosystem help explain its concentrated poverty but for the sake of simplicity, I’ll focus on just three:

1): Twentieth-Century Racism Walled Off Chester From Investment, Then Limited Mobility

Chester is one of many cities nationwide that has suffered from the twentieth-century practice of redlining, which prohibited (by law) Black residents from accessing mortgages and other loans, and which discouraged banking and other private sources of capital from being invested into neighborhoods with a sizable Black population.

The map below from the 1930s (available in the public domain) shows that much of Chester was labeled either “declining” (yellow) or “hazardous” (red) based on Black populations, closing off those areas from investment, severing their connections to the broader regional economy. And encouraging white people to leave.

The effects of official redlining—as well as disinvestment, barriers to mortgage lending, predatory real estate practices, and lack of banking services in the decades after explicit redlining was banned, have deeply harmed Black-majority places like Chester. This legacy has “a causal, and an economically meaningful, effect on outcomes like household income during adulthood, the probability of moving upward toward the top of the income distribution, and modern credit scores” according to a 2020 report from the Federal Reserve Bank of Chicago. Policies including the 1977 Community Reinvestment Act have attempted to rectify this lack of investment by pushing commercial banks to meet the needs of low-income households, But decades of deregulation have allowed commercial banks to sidestep that obligation in pursuit of higher profits, leading many households to rely on predatory fringe banking services such as payday lenders. (Recall the check-cashing center in the photo of Chester above.)

In a 2014 article for Next City, journalist Jake Blumgart details the history of Chester, including its twentieth-century status as a magnet for Black workers seeking to escape Southern racial violence. In response to the influx of Black migrants, the city’s white population began to abandon the city (taking crucial tax dollars with them), even as they used restrictive housing covenants and other legal tools to keep Black residents from following them to surrounding suburbs. Over time, this dynamic created harmful reinforcing loops: poverty intensified in Chester, leading to even less public or private investment or in-migration, even as surrounding places grew in wealth—and all of this played out along racial lines.

Blumgart notes a New York Times map based on census data from 2005-2009 showing that the majority of Delco’s Black population is still “boxed into a few municipalities, including Chester.” He further notes that that today, “most of the jobs left in city limits are not held by city residents, including those in the Harrah’s casino (opened in 2007) and the PPL Park soccer stadium (opened in 2010).” It almost goes without saying that the casino and the stadium, as with many so-called “economic development” initiatives, did nothing to revitalize the urban core of the city or create new wealth for impoverished areas on the immediate outskirts of the city.

Without new capital investment in Chester or reconnection to some of the tax revenue streams of surrounding municipalities, the cycle of Black intergenerational poverty will continue. In the words of Blumgart, “Chester’s population is trapped, abandoned by the political and economic systems.”

2): Segregation Has Gutted Public Education

Education is often presented as a magic wand to fix poverty by facilitating upward mobility. But decades of racial segregation in Chester’s public school system (both pre Brown v. Board of Education legal segregation and de facto segregation rooted in the white flight described above) have left its schools severely underfunded and understaffed.

Chester’s public schools are on track to be dismantled, fully replaced by privatized charter schools. Writing for Forbes, journalist Peter Greene clearly shows that the current “failure” of Chester’s public schools is directly linked to the loss of a middle class (and its taxes) during white flight, which was itself a reaction to the ordered desegregation of Chester’s schools.

Recall my earlier point that neoliberalism views the market as a better mechanism for providing public goods. In this case, rather than viewing Chester’s history as relevant in explaining the current challenges facing its schools, the neoliberal playbook narrowly views current performance as an indication of governmental failure. It responds by arguing that the market should take over. Unfortunately, as Greene’s piece demonstrates, the charter system in Chester has been marked by scandal and fraud, even as the underlying funding issues remain unaddressed (notably because there are no immediate “market-based solutions” to resolve those issues.)

The dire situation of Chester’s schools illustrates why education is not a silver bullet. But schooling is just one facet of Chester’s overall city budget, which faces revenue constraints across the board, given all the dynamics cited thus far, as well as environmental degradation (which decreases property values) described below.

3): Chester Residents Suffer from Environmental Degradation That Also Dampens Business Activity

Even as Chester was suffering from the loss of jobs and residents, county officials were beginning to use the city as the waste disposal site for the broader metro area. A sobering report on environmental injustice notes that between 1986 and 1997, the city of Chester became home to five waste-handling facilities, including Covanta, the nation’s largest trash-burning plant, which has a thirty-year contract to burn New York City’s trash and handles the trash generated by the Philadelphia metro area.

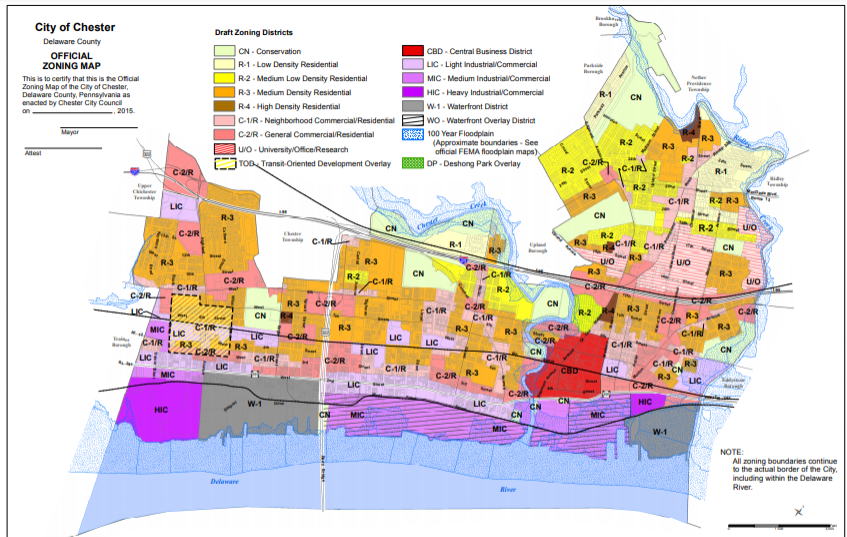

The report also asks readers to note the proximity of heavy industrial areas to both the waterfront and general residential areas in the city’s 2015 zoning map (depicted below.)

The location of waste disposal near residential areas is certainly bad for public health. But it is also bad for nearby property values. According to a study cited in The Wall Street Journal, high-volume landfills reduce adjacent property values by an average of 13.7 percent. And when you combine this depressed value with the stark reality that Black people in Black-majority neighborhoods already face systemic land devaluation of their Black homes and Black businesses, it becomes much clearer why, as Next City reports, “the median home sale price in Chester in 2012 was $20,000, compared to $69,350 in nearby Wilmington and $98,000 in Philadelphia.” (This time stamp is notable for being around when the nation began to emerge from the financial crisis, indicating that Black recovery from economic recessions is often delayed behind both the official aggregated statistics and the recovery of other racial groups.)

All the factors I’ve described in this case study are compounding. Racial segregation, white flight, and environmental injustice create reinforcing loops that continue cycles of poverty (including by circumventing the ability to build wealth through housing appreciation) while discouraging in-migration of new taxpayers and employers.

To illustrate the effects of these terrible reinforcing loops, I used economist Raj Chetty’s Opportunity Atlas tool to map poverty in the metro. The map below (with Chester highlighted in black) shows that children who grow up in poverty tend to stay in poverty.

Clearly no private investor is going to find opportunities in Chester for short-term return-on-investment. And no “market-based solutions'' are possible in a city that barely participates in the broader regional market. Likewise, no amount of nonprofit advocacy alone can bring in much-needed capital. And no amount of IRS-funneled redistribution of resources to individuals and families as social welfare will overcome the structural and systemic barriers to building communal wealth.

So where does the city go from here?

New Possibilities for Place-Based Policy

There is a growing bipartisan consensus that place-based policy making matters. This is particularly evident in the recently passed Innovation and Competition Act, a $200 billion bill promoting industrial policy that includes the creation of 18 regional innovation hubs to break the stranglehold of concentrated venture capital on the coasts while revitalizing the heartland. This bill was widely supported by Republicans and Democrats alike. And indeed, on the Right, think- tanks like American Compass advocate for this approach, while on the Left, the Biden administration has made regional equity a benchmark for many of its proposals, including the proposed infrastructure bills.

Developing regional economies can generate growth for disadvantaged communities—but it is not a given. Often in the work of building up regions, policy makers content themselves with creating greater capital flow in places, when they need to help generate durable communal wealth that stays in those communities and benefits long-term residents. Still, the focus on regions is important and welcome, and a key feature of the Biden administration’s American Rescue Plan is the way it gives state and local leaders flexibility to use federal funds to support both regional and local goals. As I argue in a recent article on Philly’s shipbuilding industry, in line with the Rescue Plan funds, even more public investment is needed to bolster local labor markets while ensuring equitable access to workforce development and job opportunities.

A promising focus of place-based policy making is emerging at the hyper-local level, inspired by Raj Chetty’s research, which as noted above finds that adult outcomes are often heavily predicated on neighborhood-level characteristics. This approach focuses on making it easier for families to escape the deleterious communal effects of concentrated poverty by moving to nearby communities with greater resources. As the perfect example, the Chester Housing Authority is among nine entities across the nation slated to receive $3.5 million in federal funding to help families relocate to neighborhoods with less poverty and more opportunity. And along similar lines, a bipartisan group of U.S. senators is proposing a bill that would create $500 million worth of incentives to expand the pool of landlords willing to provide housing to low-income households using housing vouchers.

These proposals begin to move in the right direction, since they focus on neighborhoods within a larger geographic area (often with a shared tax base) and facilitate mobility to those neighborhoods with greater resources and investment. But these bills do little to address the fundamental need to create community-based wealth. Simply moving kids out of neighborhoods with concentrated poverty does not address those who remain stuck in those neighborhoods, nor does it provide a path toward place-based revitalization.

Places like Chester require asset-based development that leverages existing assets to build communal wealth. Creating wealth-generating assets (or revitalizing underused assets) generally requires a combination of public and private investment working in tandem. For example, to respond to a food desert in North Tulsa, leaders worked together to create Oasis Fresh Market, a for-profit entity tied to a nonprofit and made possible via “investment from the Tulsa Development Authority, the city of Tulsa through HUD's Community Development Block Grant program, and various philanthropic organizations.” This asset provides everything from food to employment opportunities, while potentially generating local tax revenue that can be invested in other areas of development, including creating or revitalizating more assets.

A similar model proposed by the People’s Policy Project is for municipalities to use American Rescue Plan funds to “establish a municipal corporation or quasi-governmental entity” and “award it funding to acquire real estate and facilities.” These entities could reopen (or create new) groceries and pharmacies or provide housing at below-market rates. As an offshoot of this method, public spending can also go towards revitalizing abandoned or outdated property, creating new value while replacing outdated infrastructure (such as lead pipes) with climate- and health-friendly alternatives. This strategy is proposed by the Biden administration, whose explicit aim is rectifying historical racial injustices by decreasing the racial wealth gap. These approaches to government-supported asset development can be easily connected to community trusts and other legal arrangements that allow residents to “buy back the block” — ensuring that wealth generated by development serves community purposes (such as providing affordable housing at below-market rates) and that it does not displace long-term residents.

One of the primary goals in this approach is to generate positive spillover effects. As individual neighborhoods start to develop, their assets can be connected to assets in other nearby neighborhoods, creating leverage for even greater development spreading out across the entire city. And when that bottom-up development is big enough, it can be easily integrated into surrounding regional efforts, which in turn will attract even more public and private investment. This development can also create greater revenue streams for important public-minded financial institutions, including minority depository institutions (MDIs), community development financial institutions (CDFIs), and historically Black-owned community banks, which otherwise struggle to remain financially solvent over the long term, especially in the face of economic downturns.

Crucially, unlike the “tax incentives and rebates” neoliberal playbook that has failed to lead to revitalization, massive public investment has to be supplied first—before commercial banking and business development begin to drive growth. And there must be enough public investment to produce tangible results that begin to lure in risk-adverse private investors. In addition, at least in the short term, policy makers need to reject the neoliberal fixation on efficiency; they cannot worry too much about narrow cost-benefit analyses of this public spending because of course investing money in struggling places, as opposed to already thriving places, will get less bang for the buck—and at slower speeds. The whole point is that public investment is about doing what the market does not, namely bearing the costs and the risks associated with providing public goods and helping promote the common good.

To conclude, this case study shows that neoliberal approaches to concentrated poverty are not good enough. We need place-based approaches that leverage existing assets to create lasting communal wealth. The good news is that when places like Chester are enabled to flourish, everyone benefits: the overall local economy expands, new innovation is unleashed at the regional level, and state and federal money is freed up for more productive investment, creating virtuous feedback loops every bit as powerful as the ones perpetuating poverty. And as we use place-based policy to promote the common good, we empower citizens, their multigenerational families, and their broader local and regional communities to participate in the common good to the fullest extent imaginable.

About the Author

Anthony M. Barr

anthony.barr@pepperdine.edu

Anthony M. Barr is earning his master’s degree in public policy at Pepperdine University where he also works as a graduate assistant for The American Project. He is currently a research assistant at the Brookings Institution where he focuses on asset-based development. All views expressed here are his own.

Nancy Vorsanger

Editor

The policy recommendations and views expressed in this essay are those of the author and not necessarily the views of the organization, staff, Board of Directors, funders, or other stakeholders.

In the spirit of creativity and the free exploration of ideas, Capita commissions products from diverse viewpoints exploring how the great social and cultural transformations of our day affect young children, and to foster new ideas to ensure a future in which all children and families flourish. The products we commission are intended to contribute to a public dialogue and foster debate about securing a future in which all children and families flourish.